Debt Awareness Week: 5 facts about debt in Great Britain

January tends to be the time of year when people take a good look at their finances.

Whether it’s to plan a summer holiday or because the first credit card bill of the year has landed on their door mats, many resolve to deal with their debts.

Debt Awareness Week, which runs between January 25 and 30, aims to raise awareness of the availability of free debt advice for people who are struggling financially. This is important because people who feel burdened by their debt report higher levels of anxiety than people who do not1.

In Great Britain, 48% of all households hold some form of financial debt, that is, debt made up of non-mortgage borrowing such as credit cards, loans and overdrafts. Here we take a look at five facts about the financial debt of these households and the individuals within them2.

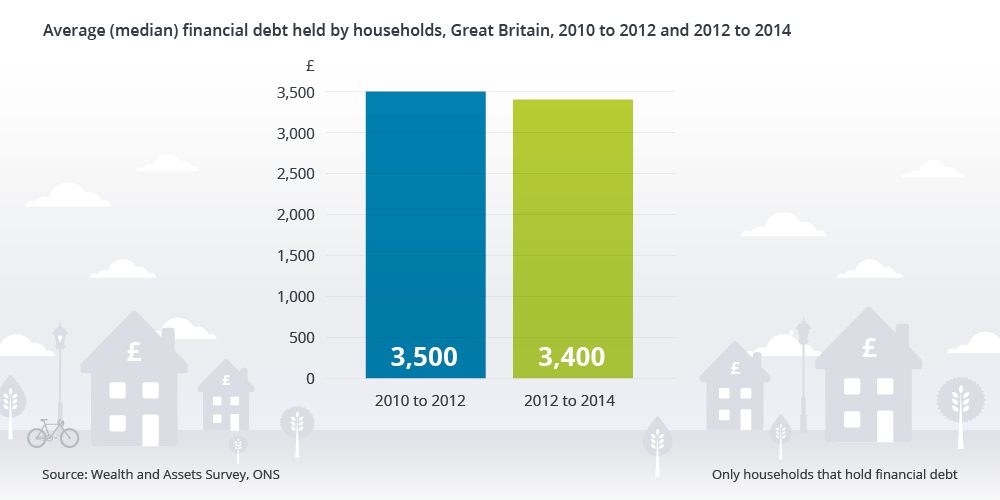

1. The average (median)3 amount of financial debt held by a household in Great Britain was £3,400 in 2012 to 2014, compared with £3,500 in 2010 to 2012.

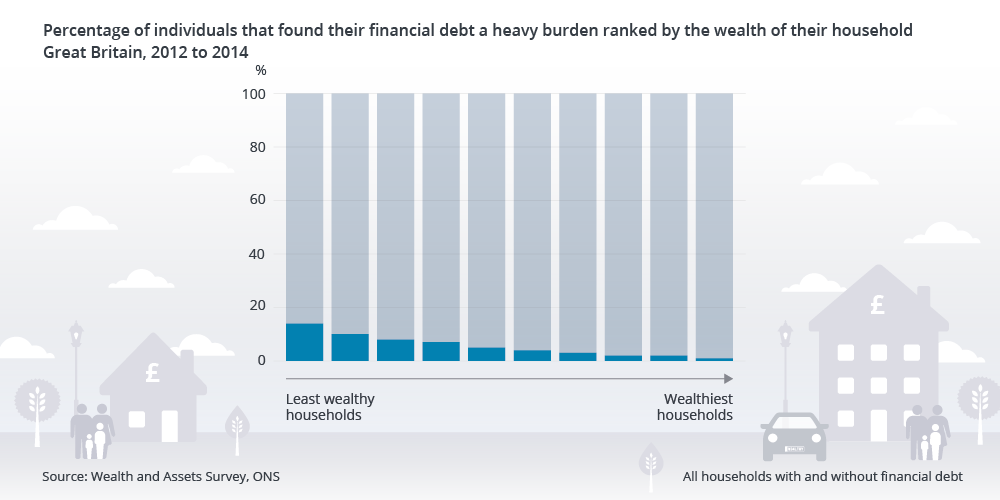

2. Financial debt was a heavy burden for 14% of people in the least wealthy households, compared with just 1% of people in the wealthiest households4.

This is despite the fact when comparing households with debt, the wealthiest have 2.6 times the average (median) amount of debt than the least wealthy.

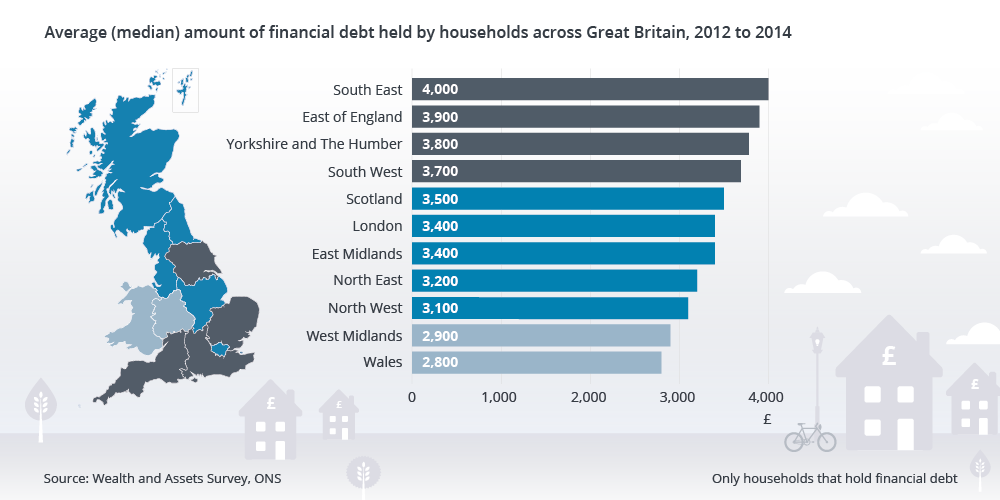

3. Households with debt in the South East had the highest average (median) debt in 2012 to 2014 compared to households with debt in other areas of Britain

Households with debt in the South East had an average (median) debt of £4,000 in 2012 to 2014. The average household debt across the whole of Great Britain was £3,400 over the same period.

Households with debt in Wales held the lowest average debt at £2,800, however this was up from £2,000 in 2010 to 2012.

Interestingly, even though households in the South East had the highest average debt, they also had the lowest percentage of people state that their debt was a heavy burden; just 16% of people with debt stated this, compared to 27% of people with debt living in London (the highest across all areas of Great Britain).

4. A quarter of 45 to 54 year olds with debt found their debt a heavy burden compared with just 12% of those aged 65 and over.

However, the 45 to 54 age group did not have the highest amount of debt for all age groups.

People aged 45 to 54 lived in households with an average financial debt of £2,000, the figure for those aged 65 and over was £1,100.

In comparison, people aged 25 to 34 lived in households with an average financial debt of £2,800 (the highest for all age groups).

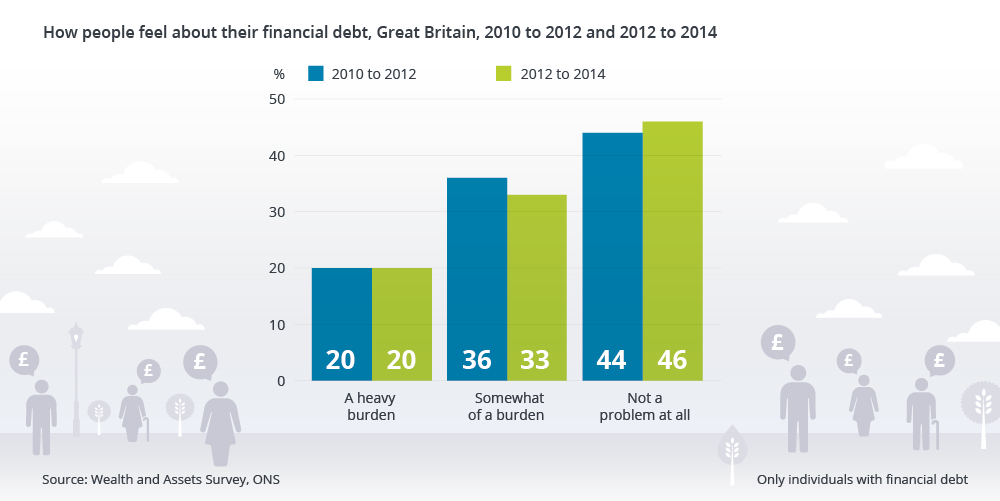

5. There has been no change in the percentage of people reporting their debt as a heavy burden.

In 2010 to 2012, 20% of people with debt reported their debt was a heavy burden. This figure remained the same in 2012 to 2014 even though the average (median) level of debt held by households has fallen.

In contrast there was a slight increase in the percentage of people with debt reporting their debt was ‘not a problem at all’ and a slight decrease in the percentage reporting their debt as ‘somewhat of a problem’.

For more information, please contact: Wealth.and.assets.survey@ons.gsi.gov.uk

Related

- Who is best at managing money? Visual.ONS article

- Extended analysis: debt burden Statistical report